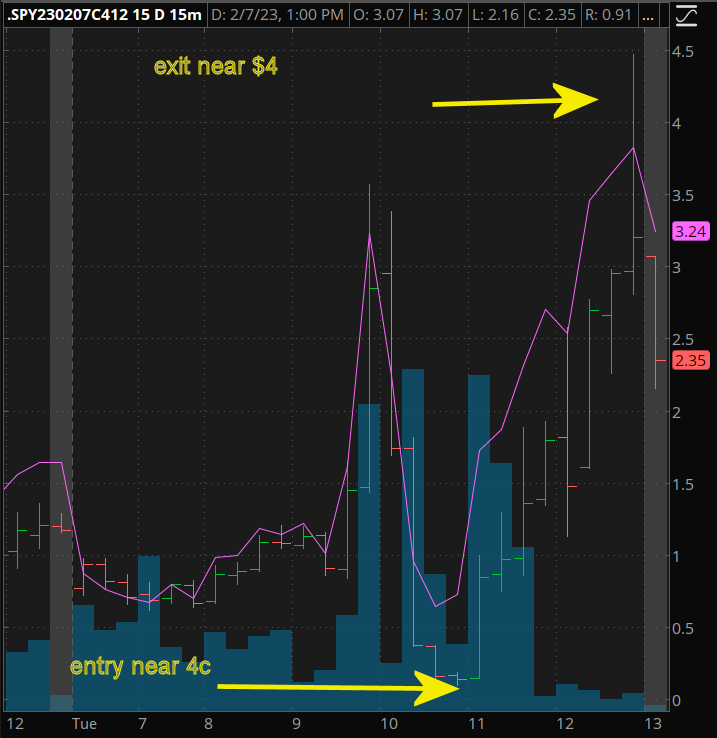

4c to $4 in 90 minutes SPY calls February 7, 2023

Feb 09, 2023On February 7th we watched the SPY move up strongly to a high of 415 around 9.30 am PST (12.30 eastern) before falling back rapidly to 408. During this period the MACD diverged to the upside. The MACD indicated prices should be nearer 412. As we have options expiring today on SPY we can look for an out-of-the-money option under 10c a contract.

With only 3 hours remaining in the trading day, this trade will be very short-term. The nearest out-of-the-money option expiring February 7, 2023, and with a price under 10c was the 412 call with an entry around 4c.

Entering the trade at 11.10 am PST, 90 minutes later the option was trading above $4

How do we do this?

The Options Hunter strategy focuses on divergencies between the MACD and the price movements of the underlying ticker. We don't include other indicators such as RSI, Stochastics, or Bollinger bands as our approach is kept simple, straightforward, and repeatable.

The main difference between weekly and monthly options is their expiration dates. Monthly options end every month on the third Friday of the month, while weekly options terminate almost every Friday and are issued on Thursdays.

Weekly options are an excellent way to make profits, and with the new QQQ and SPY daily options expiration, the potential for profits has increased.