SPY 9/1/2022 divergence forming late in the day - confirmed on 30 min next morning

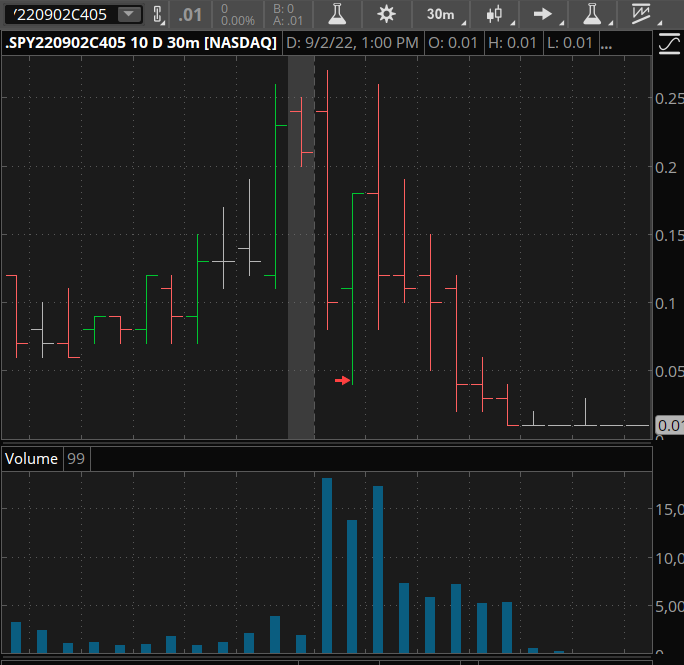

Sep 09, 2022SPY was setting up a divergence in lower timeframes late in the day on 9/1/2022. We waited until next day and saw the full divergence on 30 minute price bars in first hour of trading.

A look at the options expiring that day that were out of the money, and under a dime revealed the 405 calls trading from 3 cents upward. Holding them through the next 30 to 40 minutes of trading yielded between 17 and 22 cents gain. Not to bad for a nimble trade on the expiration day.

The Options Hunter approach focuses on divergences between the MACD and the price action. We don’t employ other indicators such as RSI, Stochastics or Bollinger bands as we keep our approach simple, straightforward, and repeatable

What are Weekly Options and Why Do I use them.

Weekly options are a great way to make money, but it can also be incredibly volatile. Trading weekly should only really be considered for experienced traders who know what they're doing because there is no guarantee that any profits will even exist in the first place!

How do Weekly Options Differ from Monthly Options?

Weekly options and monthly options are similar—the primary difference between the two lies in the expiration dates. Monthly options expire every month on the third Friday of the month, whereas weekly options expire almost every Friday and are issued on Thursdays.

Traders who were previously limited to just 12 options expirations each year with monthly options can now capitalize up to 52 expirations by adding the tool of trading weekly options to their trading portfolio.

Weekly Options are More Cost-Effective than Monthly Options

Weekly options are the best way to invest in a stock when you need maximum profit within quick time periods. They provide guaranteed market moves that last only for max two days, which means there is no risk associated with these trades because traders can always sell them before their holding period expires and make back all their money plus some extra!

Weekly Options Listings Feature Popular Stocks and Indices

Weekly options are less expensive than shares of the stock and cheaper than standard monthly ones. This is because traders have only a couple days to wait for their underlying stocks price prediction before they expire, so there isn't time sensitive premium in play here with weekly option trades - though this does mean quick opportunities can present themselves more quickly at times! The increased volatility within your holding period also

Weekly Options Maximize Profit Potential

Weekly options allow traders to profit during any kind of market environment. The short-term nature of weekly options trades calls for efficiency in a fast-paced stock market that can be highly unpredictable for long-term investments. With weekly options trades, traders can benefit from buying cheaper options and then selling them for more than purchased within a short period of time.

Regardless of the price movement, it is always possible to see triple-digit returns with weekly options buying. Unlike stocks that only benefit investors if the stock price increases, weeklies let traders benefit regardless of the stock price direction.

P.S. If you want these types of insight into the market BEFORE they happen there's a deal here for you!