Daily MACD Divergence signaled GDX decline

Aug 16, 2016

During my Tuesday, August 16 live webinar , I discussed the short term weakness in Gold Miners(GDX) apparent in the daily MACD divergence. Here’s the Chart, GDX made a new high on Friday, August 12, but the MACD clearly did not, and was in fact, lower, indicating prices should be below $30.

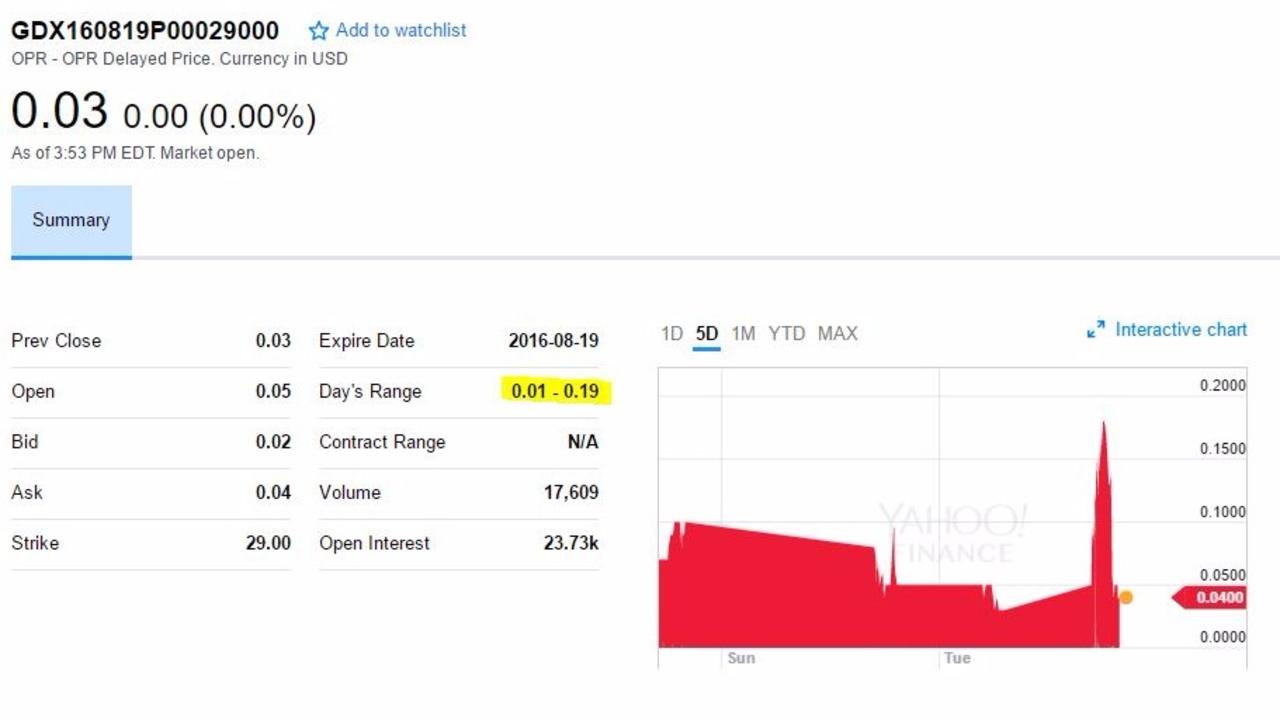

I reminded my BIG GAME subscribers early this morning with this premium tweet that only they receive. The weakness was still in place and ripe for us to exploit using our standard modus operandi; out of the money options and under 10c a contract.

With our target under $30 the GDX $29 puts looked a good option and they were under a dime. Boy did they rise fast, as high as 19c from an open of 5c that’s pretty good for a short-term trade. That’s the power of out of the money options.