Options Hunter Blog

In spite of the bad news on retailers, I see many with strong monthly MACD chart divergences: BBBY, which I showed weeks ago in class & also LB, BGFV & many others. How can YOU find these before they ...

With all of the major components like AAPL, MSFT, AMZN down, it must be putting pressure on the indexes that they are a part of & how about Volatility(VXX)? Is is showing any clear upside patterns? Wh...

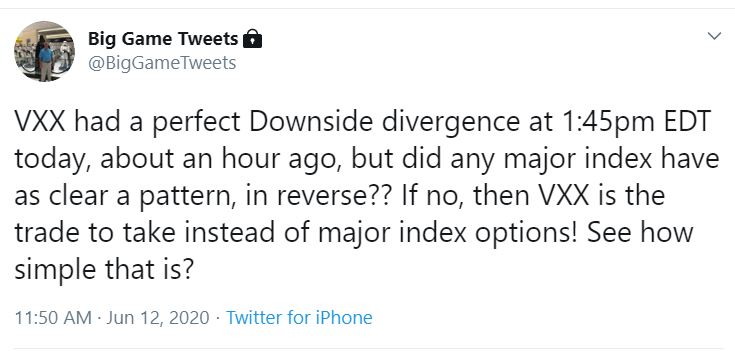

At 1:45pm eastern on June 12 the 5 minute chart on VXX made its way to the high it had reached 2 3/4 hours earlier, but we were concentrating on the MACD indicator. The MACD had a clear divergence i...

So, I'm sure there are many options traders, who are now at home and work, maybe even have a full house of family members. My commitments used to disqualify me from doing intraday options trading, n...

|

This is a daily chart with a clearly defined UPSIDE DIVERGENCE on VXX, the Fear Index. The time between the first price bottom to the second one, when the divergence occurred, was approxima... |

XOP weekly upside divergence on MACD setup with a triple bottom and MACD diverging up.

XOP 23 calls that expired December 27 2019 went from a low of $.05 on December 5, to around $1 on December 26,...

Limited openings available January and February 2020

As your Coach, I fit the training to your needs

-

I’ll show you how to find setups you can trade easily and with total confidence.

-

Get the

...

Aug 30, Nice topping pattern formid on UPS with downside MACD divergence that said prices should be around $115. this slower mover meant the best pick was sept 6 117 puts at 69c. Sep 3 took some off t...

THE TRIFUSION WORKBOOK

Leverage over 20 Years of Expertise from an Exceptional Trader.

Free workbook

You're safe with me. I'll never spam you or sell your contact info.